Register here and Avail the Best Offers!!

+91-999 9111 100

+91-999 9111 100

By Buniyad

By Buniyad 04/18/2025

The modern real estate investor doesn’t shy away from exploring investment opportunities that are far from conventional. One such newer avenue that is slowly but surely gaining visibility, especially in Delhi-NCR and other fast-emerging urban areas, is investment in society shops. Society shop investment benefits are increasingly rewarding as they are situated within residential communities and enjoy a loyal customer base. But there’s more. With long-term investment benefits come some risks too, naturally.

Let’s break down the real picture – the benefits, risks, and long-term potential of buying society shops.

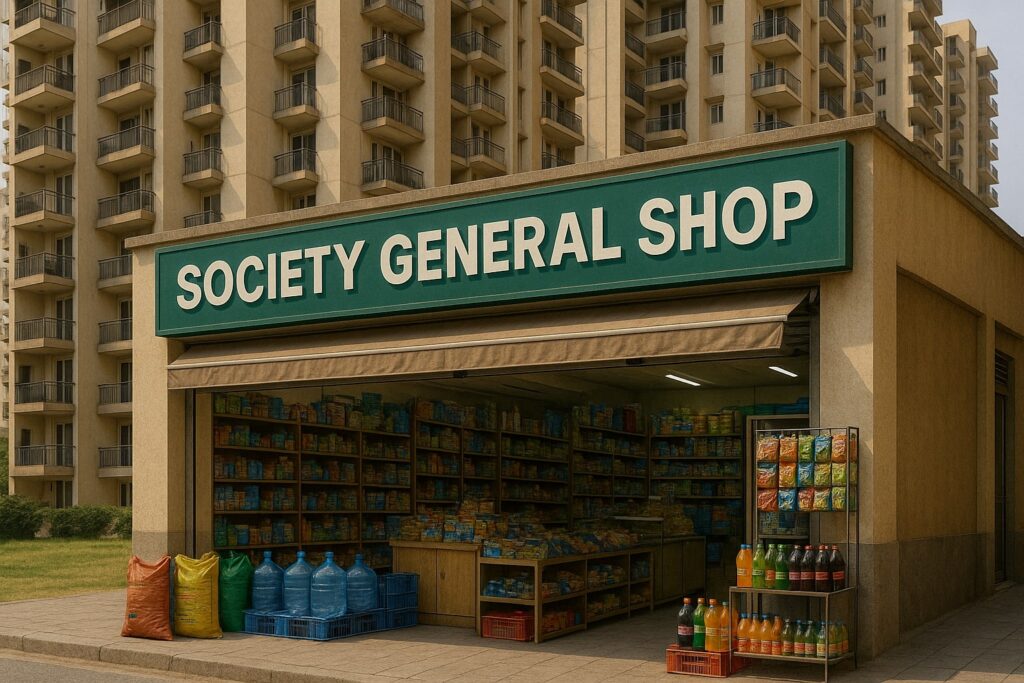

Society shops are mostly small and mid-sized commercial spaces located within or in close vicinity to housing societies or gated communities. Mostly occupied by businesses like grocery stores, pharmacy shops, cafes, gift shops, salons, clinics, handymen, and stationery stores, these shops easily and effortlessly meet the day-to-day needs of residents.

Coming to the second part of the question, endless society shop investment benefits as listed below are the reason behind a growing demand for these commercial spaces:

Since these spaces are within or very close to housing societies, the resident base provides a ready and loyal customer pool. Assurance of high footfalls is naturally the number one reason why clients invest in society shops.

Society Shops customer base results in organic business visibility, which means an entrepreneur with a business here does not need to spend huge amounts on marketing their business.

A change of mindset has been witnessed in the post-pandemic shopping scenario. Localized shopping has now become a priority, especially when it comes to essential service preference.

Investors leasing out society shops often earn a stable monthly income. Society shops rental income potential is another reason why these spaces get sold out the moment a builder launches them.

Talking about a good rental potential society shops are known for, let’s look at Delhi-NCR numbers. Society shops across urban centers like Noida, Greater Noida, Ghaziabad, and Gurugram benefit from a captive customer base, ensuring steady footfall and consistent revenue streams.

In Noida and Greater Noida, for instance, these shops command rentals anywhere between Rs. 80 and Rs. 120 per sq. ft., depending on the builder’s reputation and the location of the shops. In Ghaziabad, rentals average between Rs. 60 and Rs. 100 per sq. ft., while in Gurugram, prices can go upwards of Rs. 150 per sq. ft. Also, given its premium residential scenario.

If you compare the rental yield of society shops to that of regular commercial properties, you will find that while traditional commercial properties may offer an ROI of 4% to 6%, society shops can provide returns ranging from 6% to 8%. This is because society shops vacancy rates are lower.

In contrast, high-street shops and mall outlets often experience fluctuations in occupancy due to varying market dynamics, competition, and changing consumer behaviors. The consistent demand for daily essentials within residential communities ensures that society shops remain occupied, providing investors with stable rental income and reduced risk exposure.

The short answer: yes. The long answer contains the why and the how behind it.

If you compare the pricing of society shops to retail shops in malls or high-street markets, you will find that society shops are far more cost-effective. The entry cost is lower, making it less risky and more accessible.

Since these shops mostly stock essentials required by occupants of the nearby residential complexes, society shops tend to have high occupancy. Essentials like medical stores or grocery shops rarely, if at all, go vacant. If you have invested in one, you can enjoy not just the society shop’s rental income potential but also quick leasing and a reliable tenant base.

Society Shops customer base only goes up as the society grows and more flats get occupied. A consistent and loyal customer base means that the value of the shop also appreciates with time. Good monthly returns and capital growth are behind quick resale opportunities of retail spaces.

In stark comparison to traditional commercial shops situated in shopping malls and high-street retail zones, society shops have very low maintenance costs. As they are part of residential complexes, operational responsibilities such as security, cleanliness, and infrastructure maintenance are managed by the Resident Welfare Associations (RWAs) or the society’s management committee.

Moreover, as these society shops are within residential complexes, utilities like electricity, water, and waste management are streamlined, further simplifying operations. Society shops management advantages ensure businesses can focus on their growth while other services are in good hands.

While society shop investment benefits are many, don’t forget that every investment involves some degree of risk. As a business owner or an investor, you can try to mitigate the risk as much as possible. Here are a few points to evaluate:

Most society shops provide limited carpet area, which may restrict the type of businesses that can operate in it. This can have an impact on the rental potential.

If the society is still under development or doesn’t have full occupancy yet, your retail shop inside or near the residential complex may not fetch great returns immediately.

Some residential societies impose stringent rules on the kind of commercial activity allowed. Before investing, you must check permissions, society shop maintenance costs, and usage restrictions, if any.

However, if you follow certain tips, you can take society shop investment benefits really high:

When scouting for retail shops, pick established societies with high occupancy.

Check legal clearances, and see if the shop space is freehold or leasehold. Also vet if all the approvals are in place.

Ensure utility-based businesses (grocery, pharmacy, etc.) are given preference over niche services.

Compare rental yield with other commercial properties in the area to get a fair idea about the rental yield you can expect from your investment.

You must also understand the market condition. If there is too much competition, the business opportunity may never grow exponentially. Investing in developing residential areas with at least a couple of established housing societies already present may prove beneficial.

By providing essential goods and services within residential complexes, society shops reduce the need for residents to travel long distances, promoting local spending and supporting neighborhood businesses. These retail spaces are known to serve as economic catalysts, driving community development, supporting local entrepreneurship, and promoting sustainable economic practices within residential complexes.

If the operational strategies of the investor are in place, a society shop can offer excellent returns on investment with relatively low risk. They are functional, affordable and enjoy a loyal customer base. Many investors recently suggested long-term leasing and loading of society shops in a residential shopping complex similar to residential units to make this investment even more profitable and risk-averse from saturated market conditions.

If you wish to look at the commercial shop in Sector 18 Noida, we at Buniyad Realty have some excellently performing options. Get in touch with us today for your smart, risk-balanced investment.

Q 1. Does one need to pay maintenance charges for society shops?

A. Yes, shop owners typically pay a minimal monthly maintenance charge to the society, which covers common services like cleaning, common area lighting, and security.

Q 2. Are society shops a good investment in 2025?

A. Yes, because of low entry cost, steady footfall, and consistent rental yield, society shops, if chosen wisely, are considered a good investment for small and medium investors.

Q 3. What is the average rental yield from society shops?

A. Typically, rental yields can range from 5% to 9%, depending on location, occupancy in the society, and the type of business operating.

Q 4. Can society shops be leased easily?

A. Yes, because of their utility-based nature and demand from local businesses, leasing a society shop is usually easier than high-street commercial spaces.

Q 5. What kind of businesses work best in society shops?

A. Essential services like grocery stores, pharmacies, ATMs, salons, gift shops, stationeries, and cafés tend to perform well in society shops.

Q 6. How does footfall affect society shop returns?

A. Higher society occupancy directly boosts footfall, increasing business viability and ensuring regular rental income.

Q 7. Do society shops require special permissions?

A. It depends on the local authority and society’s rules. Always ensure commercial use is approved for the shop you are planning to purchase.

Q 8. Should I buy a shop in an under-construction or ready-to-move society?

A. To mitigate risk and start earning from day 1, it is safer to invest in a ready-to-move or well-occupied society where footfall and rental potential are already established.

Also Read: Why Invest in One of the Many Thriving Industrial Areas in Noida?

In recent years, Noida has witnessed an uptick in […]

If you have been reading about the […]

When two or more countries sign trade […]

Presented as usual on 1st February, 2026, […]

Once known only as a satellite township […]

Real estate centered around airports has always […]

Greater Noida has today grown into one […]

Touted as a major step in the […]

Buniyad Blog is proudly powered by WordPress

Head Office

G-57/58 , Buniyad Chowk, Sector-18, Noida Uttar Pradesh

+91-999-9111-110Greater Noida

S.L. TOWER 1ST FLOOR, ALFA COMMERCIAL BELT, Noida Uttar Pradesh

+91-020-42040004South Delhi

A-32, First Floor, Feroz Gandhi Rd, Lajpat Nagar-II,New Delhi.

+91-11-41006000Gurugram

JMD REGENT SQUARE GF-11 M.G. ROAD,Gurugram 122001

+91-124-4313200